Company Update / Healthcare / IJ / Click here for full PDF version

Author(s): Andrianto Saputra +62 21 5088 7168 ext. 712;Lukito Supriadi

- 1Q24 net profit of Rp289bn (+25.5% yoy/+25.8% qoq), came in-line with our/consensus estimate at 27/26%, EBITDA/revenue also in-line.

- Stellar 1Q24 EBITDA margin of 37.3% (vs. 35.1/34.0% in 1Q23/4Q23) was due to GPM improvement and ahead of ours' (35.9%).

- We upgrade to BUY with TP of Rp3,100/sh as we revised up our FY24/25F EBITDA by +4.6/+7.2%.

1Q24 EBITDA was in-line with our/consensus estimate

delivered 1Q24 net profit of Rp289bn (+25.5% yoy/+25.8% qoq) and this was in-line with our/consensus estimate at 27/26% (vs. 5yr avg. exclude covid period of 26%). 1Q24 revenue rose to Rp1.2tr (+21% yoy/+12.3% qoq), also in-line with our/consensus estimate at 26%. 1Q24 EBITDA recovered to Rp464bn (+28.5% yoy/+23.4% qoq) with EBITDA margin of 37.3%, came in-line with our/consensus estimate at 28/27%. To note, 1Q24 revenue growth was above' company guidance of +12.5-15.0% in FY24F, while 1Q24 EBITDA margin was slight above company guidance of 35.5-37.0%.

Margin improvement on the back of higher private revenue contribution

Robust 1Q24 revenue yoy/qoq growth was driven by stellar inpatient revenue intensity (+6.6% yoy/+2.2% qoq) and inpatient traffic (+16.6% yoy/+7.0% qoq). It is worth highlighting that higher revenue intensity was due to private service ASP hike of 5-7% and drugs price hike of 8-10% in early Jan24. In addition, robust 1Q24 inpatient traffic was partly due to dengue hemorrhagic fever (DBD) as we have discussed previously (link), resulting in higher Bed Occupancy Rate (BOR) of 64.1% (vs. 58.6/59.1% in 1Q23/4Q23). Moreover, 1Q24 JKN' revenue contribution declined to 15.7% (vs. 18.2/17.3% in 1Q23/4Q23). Hence, 1Q24 GPM improved significantly to 53.5% (vs. 49.1/50.2% in 1Q23/4Q23). 1Q24 opex to sales rose by 199bps yoy to 22.4% as salary as % of sales rose to 8.0% (+143bps yoy).

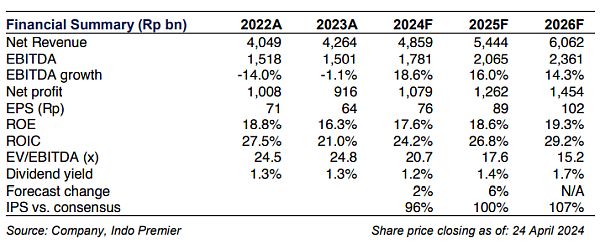

Revised up our FY24/25F EBITDA by +4.6/+7.2%

maintains its FY24F revenue guidance of +12.5-15.0% yoy and EBITDA margin at range of 35.5-37.0%. In sum, we revised up our FY24/25F EBITDA by +4.6/+7.2% respectively to incorporate robust 1Q24 top-line growth and higher than expected EBITDA margin.

Upgrade to BUY with TP of Rp3,100/sh

We upgrade to BUY rating with TP of Rp3,100/sh based on 23.0x FY24F EV/EBITDA (in-line with its 5yr mean). Risk is soft revenue growth on private sector (out-of-pocket).

Sumber : IPS